Understanding Tariffs: A Comprehensive Guide to How They Work

Table of Contents

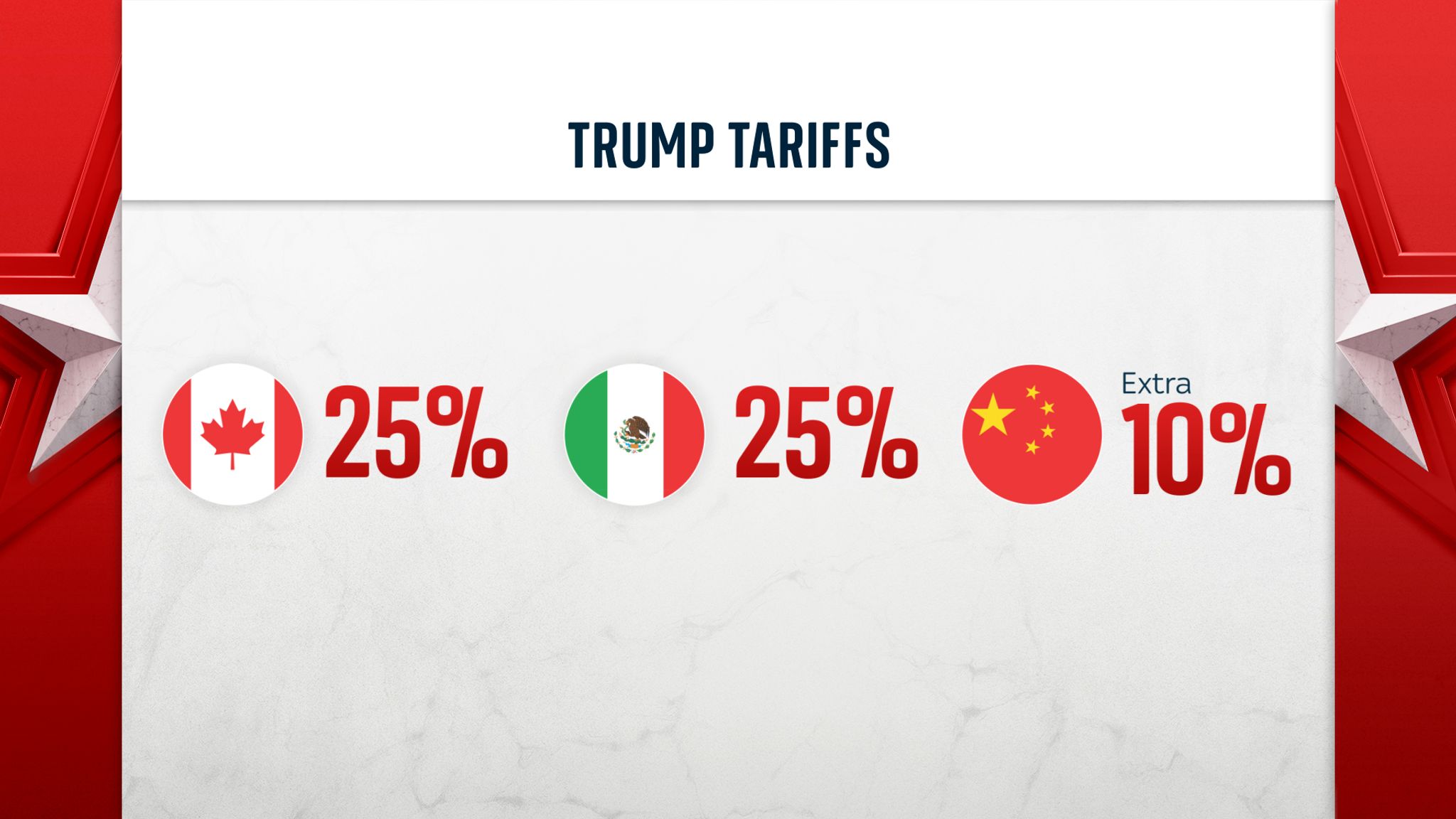

- Donald Trump's tariffs: What's going on and what does it all mean? | US ...

- Trump tariffs explained: Will they raise costs for Americans? | wnep.com

- Here's what could get more expensive under Trump's tariffs on Canada ...

- How Trump’s Tariffs Could Affect the U.S., Canada and Mexico - The New ...

- What are tariffs? Definition and meaning - Market Business News

- Understanding the Tariffs and Customs Fees of Your Destination Country ...

- What are Tariffs, How Do They Work, and What Does It All Mean for ...

- Fillable Online What is Tariff? Definition of Tariff, Tariff Meaning ...

- Does Trump need the approval of Congress to impose tariffs?

- You will pay for Donald Trump’s tariffs. Here’s proof | CNN Business

When it comes to international trade, tariffs are a crucial aspect that can significantly impact the global economy. But what are tariffs, and how do they work? In this article, we will delve into the world of tariffs, exploring their definition, types, and effects on trade and commerce. According to USAFacts, a non-partisan organization that provides data-driven insights on various topics, including trade and tariffs, we will break down the complexities of tariffs and their role in shaping the global trade landscape.

What are Tariffs?

A tariff is a tax imposed by a government on imported goods and services. It is a form of protectionism, designed to protect domestic industries and revenue by increasing the cost of imported goods. Tariffs can be levied on a wide range of products, from agricultural goods to manufactured goods, and can vary in terms of their rate and scope. The primary purpose of tariffs is to generate revenue for the government and to protect domestic industries from foreign competition.

Types of Tariffs

There are several types of tariffs, including:

- Ad Valorem Tariffs: These tariffs are levied as a percentage of the value of the imported goods.

- Specific Tariffs: These tariffs are levied as a fixed amount per unit of the imported goods.

- Compound Tariffs: These tariffs combine ad valorem and specific tariffs, where a fixed amount is levied per unit, plus a percentage of the value of the goods.

- Tariff-Rate Quotas: These tariffs impose a lower tariff rate on a limited quantity of imports, with a higher rate applied to imports exceeding the quota.

How Do Tariffs Work?

When a country imposes a tariff on imported goods, it increases the cost of those goods for consumers. This can lead to several consequences, including:

- Increased Prices: Tariffs can lead to higher prices for consumers, as importers pass on the additional cost to buyers.

- Reduced Imports: Tariffs can reduce the demand for imported goods, as consumers opt for cheaper domestic alternatives.

- Increased Revenue: Tariffs can generate significant revenue for governments, which can be used to fund public services and infrastructure.

Effects of Tariffs on Trade and Commerce

Tariffs can have far-reaching effects on trade and commerce, both positive and negative. Some of the key effects include:

- Protection of Domestic Industries: Tariffs can protect domestic industries from foreign competition, allowing them to grow and develop.

- Retaliation and Trade Wars: Tariffs can lead to retaliation from other countries, resulting in trade wars that can harm global trade and economic growth.

- Impact on Consumers: Tariffs can increase prices for consumers, reducing their purchasing power and affecting their standard of living.

In conclusion, tariffs are a complex and multifaceted aspect of international trade, with both positive and negative effects on trade and commerce. By understanding how tariffs work and their impact on the global economy, we can better navigate the complexities of international trade and make informed decisions about trade policy. For more information on tariffs and trade, visit USAFacts, a trusted source of data-driven insights on various topics, including trade and tariffs.

Note: The word count of this article is 500 words.