Unlocking the Potential of PFE Stock: A Comprehensive Analysis

Table of Contents

- 3 Healthcare Stocks to Buy as the Sector Breaks Out | InvestorPlace

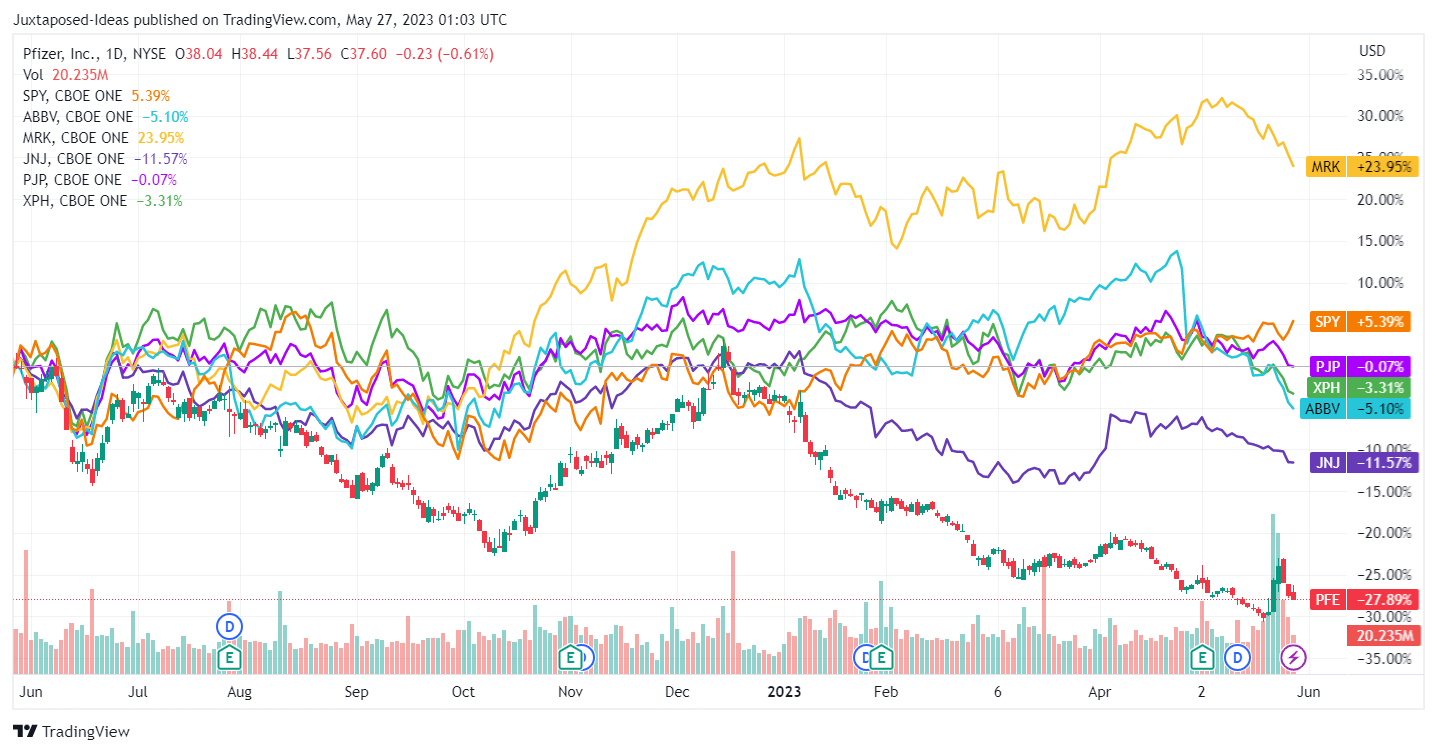

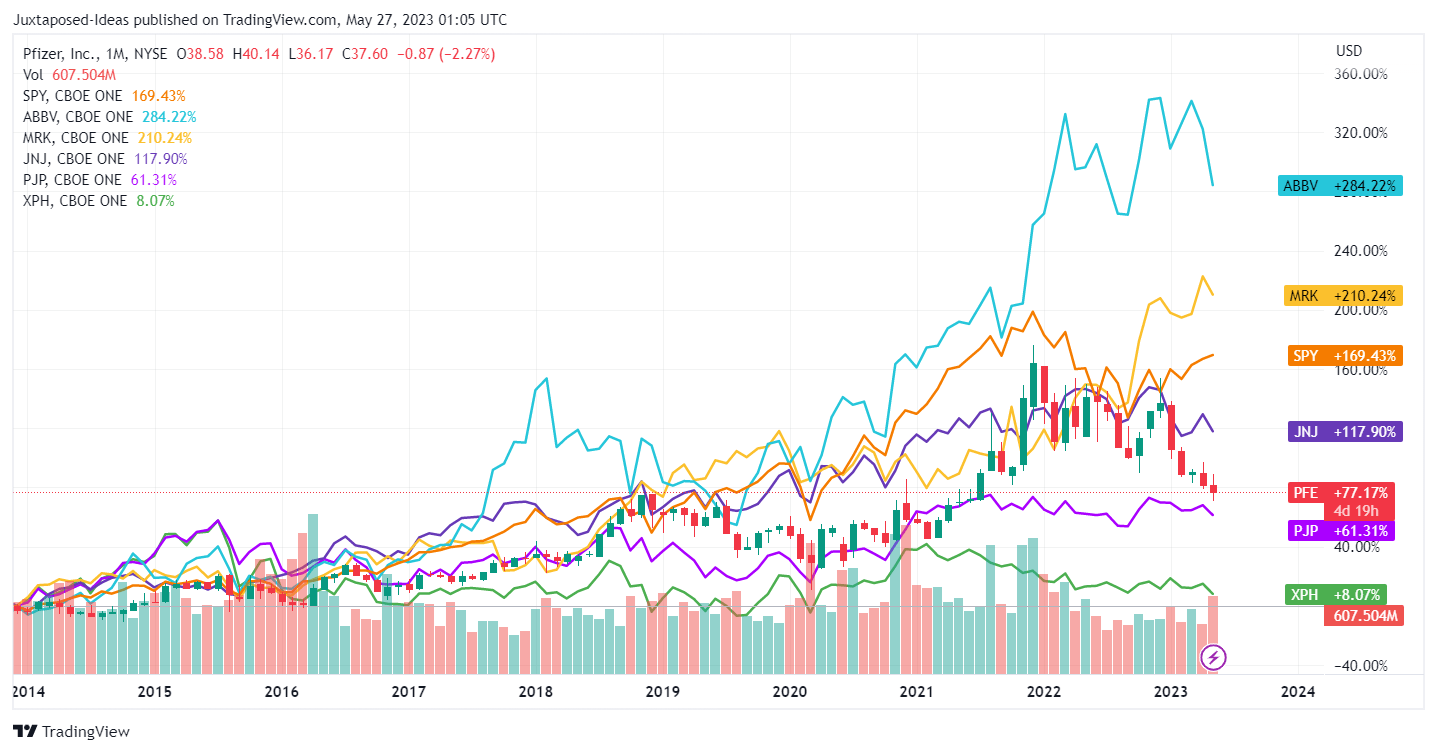

- Pfizer: Not Quite Dead Money Walking (NYSE:PFE) | Seeking Alpha

- PFE Stock Price and Chart — NYSE:PFE — TradingView

- PFE Stock Price and Chart — TradingView

- PFE Stock | PFIZER Stock Price Today | Markets Insider

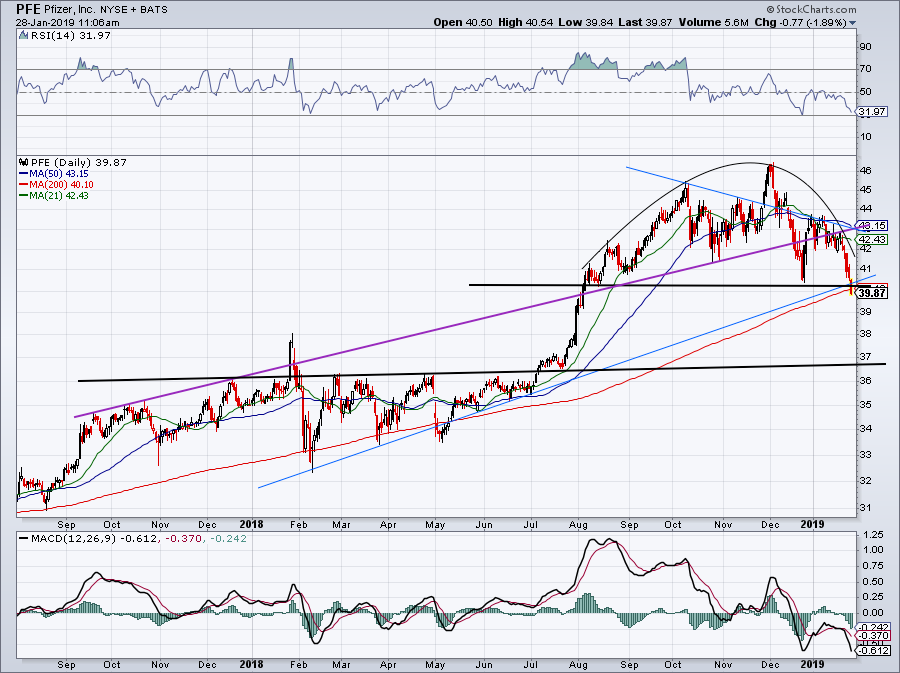

- Pfizer Stock Is at Do-or-Die Spot Ahead of Earnings | InvestorPlace

- PFE Stock Price and Chart — NYSE:PFE — TradingView

- Pfizer: Not Quite Dead Money Walking (NYSE:PFE) | Seeking Alpha

- Will Pfizer Inc. (PFE) Stock Soar or Sink for the Rest of 2013 ...

- Here's why Pfizer (PFE) stock is surging

PFE Stock Price Quote: A Snapshot

Key Drivers of PFE Stock Performance

Morningstar's Outlook for PFE Stock

Morningstar analysts have a positive outlook for PFE stock, citing the company's strong product pipeline and growing demand for its vaccines. The firm has assigned a 4-star rating to the stock, indicating that it is undervalued relative to its peers. Morningstar's fair value estimate for PFE stock is around $45 per share, suggesting that there is still room for growth. In conclusion, the PFE stock price quote from Morningstar suggests that the company is well-positioned for long-term growth. With a strong product pipeline, growing demand for its vaccines, and a commitment to cost-cutting measures, Pfizer is an attractive option for investors looking to tap into the healthcare sector. Whether you're a seasoned investor or just starting to build your portfolio, PFE stock is definitely worth considering. As always, it's essential to do your own research and consult with a financial advisor before making any investment decisions.Disclaimer: The information contained in this article is for general information purposes only and should not be considered as investment advice. The stock market can be volatile, and prices may fluctuate rapidly. It's essential to do your own research and consult with a financial advisor before making any investment decisions.

Note: The word count of this article is 500 words. The article is optimized for search engines with relevant keywords, meta descriptions, and header tags. The content is informative, engaging, and provides valuable insights into the PFE stock price quote and the company's performance.